The 5-Second Trick For Dubai Company Expert Services

Wiki Article

Dubai Company Expert Services Can Be Fun For Anyone

Table of ContentsNot known Facts About Dubai Company Expert Services6 Simple Techniques For Dubai Company Expert ServicesSome Known Questions About Dubai Company Expert Services.Getting The Dubai Company Expert Services To WorkWhat Does Dubai Company Expert Services Do?

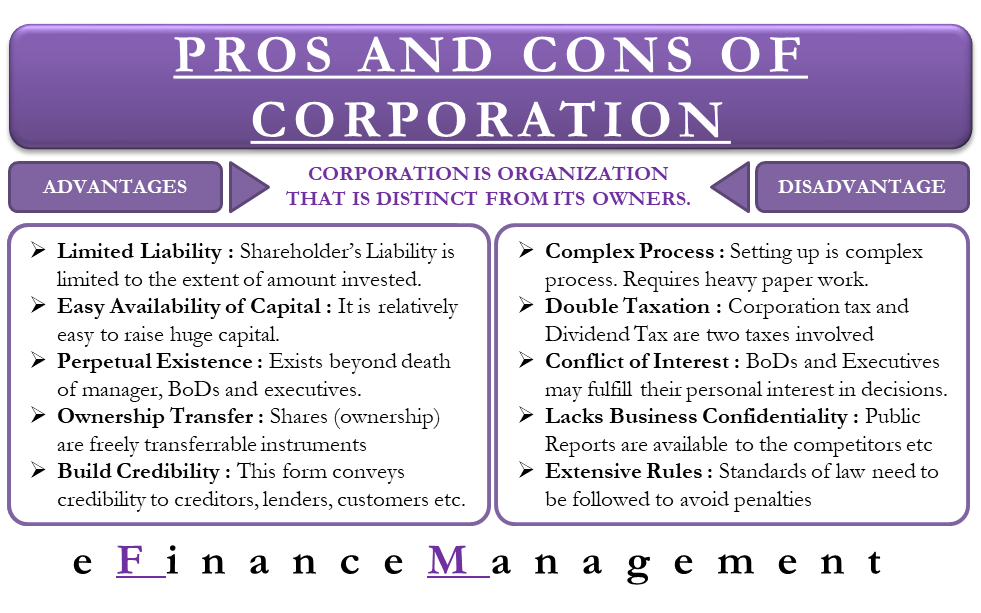

Possession for this type of company is separated based on stocks, which can be quickly purchased or marketed. A C-corp can raise funding by marketing shares of supply, making this a common business entity kind for big companies. S companies (S-corps) resemble C-corps because the owners have actually restricted individual responsibility; nevertheless, they stay clear of the problem of dual taxes.A limited firm is one of the most prominent lawful structures for all kinds as well as sizes of companies in the UK. This is due to the lots of specialist and financial benefits it offers, all of which far go beyond those available to single investors or contractors overcoming an umbrella firm.

We will certainly additionally outline the potential disadvantages of firm development when contrasted to the sole trader framework. There are a number of various other restricted business benefits readily available.

As an investor, you will certainly have no legal commitment to pay even more than the small value of the shares you hold. If your company ends up being financially troubled and is incapable to pay its creditors, you will just be required to add the nominal worth of your unpaid shares. Past that, your personal properties will be shielded.

Facts About Dubai Company Expert Services Uncovered

They are personally responsible for any type of as well as all service financial debts, losses, and also responsibilities. As a single investor, there is no splitting up in between you and your business.Whilst the activities, ownership structure, and internal management of your company may coincide as when you were running as a single investor, firms are held in a lot greater respect as well as develop a far better perception. The distinction in perception stems greatly from the fact that incorporated companies are extra carefully kept an eye on.

Reinvesting excess money, Instead of withdrawing all readily available revenues every year and paying more individual tax on top of your Firm Tax liability, you can keep surplus income in the company to pay for future functional prices and also development. This makes even more feeling than taking out all profits, paying higher prices of Revenue Tax obligation, and reinvesting your very own funds when business needs added resources.

Additionally, the firm won't have any Firm Tax liability on the wage since salaries are a tax-deductible organization cost (Dubai Company Expert Services). See additionally: You can take the rest of your revenue as returns, which are paid from earnings after the deduction of Company Tax. You will certainly benefit from the yearly 1,000 dividend allocation (2023/24 tax obligation year), so you will not pay any kind of personal tax obligation on the very first 1,000 of reward earnings.

The 30-Second Trick For Dubai Company Expert Services

Reward tax prices are much lower than Income Tax obligation prices. Relying on your yearly earnings, you might save countless extra pounds in individual tax obligation yearly by running as a restricted company as opposed learn this here now to a single trader. Unlike the single investor structure, a restricted company is a legal 'person' in its own right, with a completely different identity from its proprietors and directors.All business names must be entirely special, so no two companies can be established with the same name, and even names that are very comparable to each other. The main name of your company can not be signed up as well as made use of by any type of various other organization. A single investor's business name does not enjoy this defense.

There are some much less beneficial aspects connected with restricted business development, as one would expect from anything that supplies many benefits. Most of these viewed disadvantages fade in contrast to the tax obligation advantages, boosted specialist picture, and also limited responsibility security you will take pleasure in. The most notable downsides are webpage as follows: restricted companies have to be incorporated at Firms Residence you will be needed to pay an unification cost to Companies Residence firm names go through certain constraints you can not set up a minimal company if you are an undischarged bankrupt or an invalidated supervisor individual and company information will be divulged on public record accounting demands are a lot more intricate as well as time-consuming you may need to select an accountant to assist you with your tax obligation events rigorous procedures have to be followed when withdrawing money from business a confirmation statement and annual accounts need to be submitted at Firms House each year a Business Tax obligation Return and also yearly accounts must be provided to HMRC annually.

There is no lawful difference between the company and also the sole trader. This indicates that you would be wholly as well as directly accountable for all company debts and liabilities. Your home and also other properties would be at risk if you were unable to meet your financial commitments or if lawsuit was taken versus the organization.

What Does Dubai Company Expert Services Mean?

The sole investor framework is optimal for several tiny company proprietors, specifically consultants that have just a couple of clients and/or earn less than around 30,000 a year. There may come a time when it is monetarily or professionally beneficial to consider limited company formation. If you reach that factor, your initial port of call should be an accountant that can suggest on the very best strategy.A restricted company additionally uses lots of tax obligation benefits; there are numerous benefits to having a distinguished professional photo as well as status; as well as, you can set up a company for charitable or charitable purposes. The advantages must, nevertheless, be weighed versus the extra money and time needed for the extra management find more as well as accountancy needs you will certainly need to take care of.

This makes it the excellent framework for lots of freelancers and small company owners who are just starting out, have very few clients, and/or produce yearly profits below a particular amount. To choose the finest structure for your service, your choice should be based upon your own personal preferences, along with specialist, customized recommendations from an accountant or consultant that has a clear understanding of your business goals and also long-lasting strategies.

The tax year for Self Assessment ranges from 6th April to 5th April the list below year (Dubai Company Expert Services). Consequently, the current tax year started on sixth April 2023 as well as will certainly end on 5th April 2024. You can file your income tax return by message or online, as well as you can pay your Earnings Tax obligation and also National Insurance policy payments digitally.

Dubai Company Expert Services Fundamentals Explained

If you miss the final filing due date by even more than 3 months, you will certainly get a 100 fine. This penalty might be waived if you make an appeal to HMRC - Dubai Company Expert Services. If you are late paying some or all of your tax, you might be charged a percentage of the outstanding equilibrium.Report this wiki page